Matas

Strategy

With 296 stores operating in Denmark and as a market leader in each of their key segments (62% in high end) the incumbent status of Matas is undiscussable. However, whilst successfully penetrating the Danish market, their prospect of expanding into Sweden failed.

With this lesson learned, it seems improbable that they would initiate such undertakings in the nearest future. Instead, their focus rests on expanding their online shop as well as their big data experiment Club Matas. As they currently are in the second stage of implementing the Club Matas loyalty program, the database is now sufficient to start tailoring the marketing. Based on the historical purchases and costumer information, the targeted marketing has the potential to increase the brand value and the customer satisfaction.

The 1.4 million members, including 60% of all women in the age 18 to 65 years, receive marketing only for products relevant to them when it is statistically relevant. The consumer habits registered in the database will enhance the ability to help costumers select presents to a member. Based on what and when the members purchase, the database will suggest a product likely to be successful. In an effort to attract non-recurring customers, Matas has initiated the ClubM partner program with diversified partners such as Apollo, Saxo, fitnessdk, and more to expand the Club Matas.

The target marketing could prove beneficial to Online shoppen, as links to promoted products, for example, could feature in emails. Furthermore, it is an increasingly popular trend to shop at home, and the shopping for the regular, standard products becomes easy, as the database will know the members habits. However, a threat is present here. Matas will be challenged on the price of the goods, because other websites does not face the operating cost of 296 physical stores including staff.

The future holds a slurred potential. The concepts of the StyleBox stores is to provide high-end beauty products and gain market share from the saloon retail. According to the management, the concept will prosper because of the current edge and knowledge in the high-end beauty segment. Likewise, the management values the prospect of liberating the pharma market highly; two DKK billions is spend on prescription drugs. This is still remote, but Matas will surely profit from such liberation.

Management

Since the IPO (June, 2013), the board of directors has undergone significant changes. These changes are crucial to analyse and contemplate, as the board sets the main objectives for the enterprise. It is especially interesting to consider how the board wishes to emphasise investor relations compared to organic growth, thus changing and elucidates the perspective in which the stock is to be interpreted. The board has coerced directions for the capital structure of the company; marginally decreasing the debt load with an ultimate aim of total debt equal two times adjusted EBIDTA. This goal is nearly fulfilled and henceforth retained profits will be used for share repurchasing schemes (the first which was launched in November 2014 and last until ultimo May 2015), as well as a promised dividend flow to the investors of 60% adjusted after tax earnings. Indeed, this sends a clear signal to investors and evidences a resilient commitment from the management to emphasise investor focus, but it also substantiate our claims from above; organic growth opportunities are limited in an already penetrated Danish market. Due to the young age of this stock the commitments from the board must first stand the test of time, as the young stock has only paid out dividends one time (224 mil DKK or 5,5kr pr. share), the investment panel remains pendant to the promises of the board and intriguingly awaits the forthcoming annual statements.

Valuation

The valuation will feature a discounted free cash flow model based on the past five years of performance, as well as a 5-year forecast of key value and ultimately enforcing a terminal period. Moreover, due to the unique status of Matas in Denmark, no apparent peers exists, hence conventional remedies for triangulating the DFC results have been made problematic. Looking abroad, it is also difficult to find an enterprise resembling Matas, hence this valuation will not feature our traditional peers analysis. Lastly, due to the short data historical stock data available, it is also challenging to obtain reliable estimates of Matas beta.

Over the historic period Matas A/S have had a solid, but modest, revenue growth of 2-4% on a yearly basis as well as keeping strict cost margins of 45-46% throughout the period. As a mature company, these key value drivers have remained under control, and helped us estimating future values on a more steadfast basis. Additionally, as they have reached a state where their growth opportunities are not obvious, they have successfully turned their focus inwards and focusing on optimizing their balance sheets and costs structures. They have successfully decreased their working capital from 500 DKK millions (2010) to just above 100 DKK millions in (2014). Finally, their net investments also reflect the panel’s judgements about the nature of the stock; their historical capital expenditures have spanned from 40-60 DKK million on a yearly basis. However, depreciations have, in general, been above this i.e. they have had net negative investments throughout the historical period.

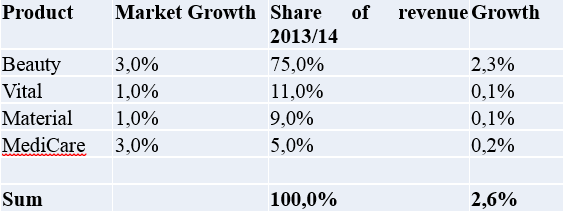

The investment panel establishes reasonable estimates on the individual future growth rate of the product series:

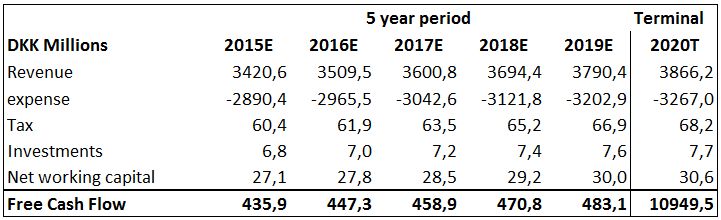

Finally yielding our estimates of their cash flow in the future

WACC

The calculation of the weighted average cost of capital was performed by the originally model. Since the area of WACC has a huge impact at the valuation, it is important to remember to be sceptical for the following calculation. At the following, it is only the more important variables there will be mentioned.

As a risk free rate the Danish ten year government bond is used plus a risk which end at 1,00 %. The risk is done to compensate for the high volatility of bonds at the time. Next, the stock sensitivity to the market was found by the unlevered beta for the retail of the special lines of Europe plus an adjusting. The value ends up at 1,19. Then the expected return of the market was found of the total equity risk premium for Denmark, which was 6,97 %. Together the calculation of the expected return ends at 8,10 % and in closing the total WACC ends at 6,50%.

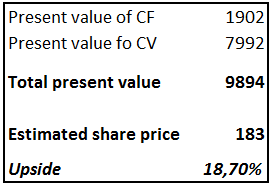

With an estimated WACC of 6,5% this yields a fair value of 183kr DKK pr. share which gives and upside of 18,7%.

Conclusion

Matas A/S is classical dividend stock. It promises no bold prospects for the future, no large capital gains. Fundamentals and aims, established by the board, entail increasing focus on investor relations and dividend payout and less on growth. Ultimately, this motivates a twofold conclusion – contingent on the portfolio preferences embedded by the investor considering this stock.

For the investor actively seeking risk and short-term capital performance, this stock will not yield promising results hence enforcing a “HOLD” recommendation. Contrarily, the investor who instead wishes to exploit the long term opportunities rooted in this stock it just might be a good opportunity to buy a stock, which does not entail any significant industry or firm specific risk components, but comprises a dividend machine, satisfying long term investment needs and a solid dividend stream, thus inflicting a “BUY” recommendation.

Authors: Jesper Kjær Bahlke, Henrik Hallengreen Jensen, Johan Stax Jakobsen