Nordfyns Bank

Nordfyns Bank is a Danish local bank located in the Northern part of Funen, holding eight branches in Kerteminde, Odense and Middelfart. The bank is quoted on the NASDAQ OMX Copenhagen stock exchange. The bank – amounting to a market cap of DKK 180 million – is intended primarily for small businesses and private costumers.

The banking sector

The sector has been heavily criticized and unpopular in recent years following the 2008 financial crisis.Among the most prominently discussed causes to the failure of 19 out of 44 quoted Danish banks are that banks seem to have been taking advantage of too kind regulations and excessive risk taking among managing directors. As a consequence banks are now facing harsher regulations exemplified by the increased capital requirements following the 2013‐2019 Basel III roll out and other regulatory initiatives, reducing the risk of future failures. Legislative

requirements are expected to further tighten in coming years, which is expected to affect especially small banks. It can be further noted that the financial crisis in general stressed small banks proportionally more than larger banks. This has resulted in a tendency towards consolidation within the sector. Upon the financial crisis negative vibes has been surrounding the Danish banking sector, leading many investors to avoid the sector. However, the recent 2013 yearly report from Finansiel Stabilitet calms

the people, pointing out “the end of the financial crisis” as Danish banks are now well capitalized. The European Banking Authority takes it the step further and declares Denmark “the neat guy of the class”, when glancing at the robustness of the banking sectors across Europe. Hence, referring to recent reports it seems like the cautiousness among investors is quiet unfounded. However, a few ghosts are still tumbling out of the closets. Latest, Finanstilsynet paid a visit at Sydbank finding a large amount of

rotten loans leading to a DKK 500 million write down. Thus, though the Danish bank sector now seems healthy, it still proves a bit moldy in the corners, suggesting investors to do a thorough quality assessment of bank subjects before any commitment.

Quality assessment

The quality assessment of Nordfyns Bank is partly based on “Tilsynsdiamanten” – a rating system published yearly by Finanstilsynet rating the healthiness of banks along five dimensions – and the generally accepted yearly risk assessment report by Niro Invest. These reports are supplement by thorough examination of the lending portfolio and write down profile of Nordfyns Bank. The risk rating Niro Invest focuses on capital adequacy, industry concentration, depreciation, profitability, business development and earnings. Notably is the large continuous improvement from rank 70 to a solid rank 20 in the period 2008‐2012. This witnesses a capable and responsible management significantly improving the risk profile of Nordfyns Bank relative to other banks.

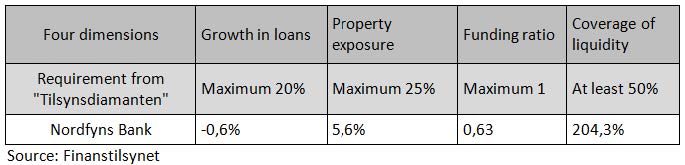

Looking at “Tilsynsdiamanten”, Nordfyns Bank is only assessed within four dimensions; growth in loans, property exposure, funding ratio and coverage of liquidity. As evident from Table 2, Nordfyns Bank meets all requirements with a significant margin. This indicates that Nordfyns Bank is indeed a healthy bank.

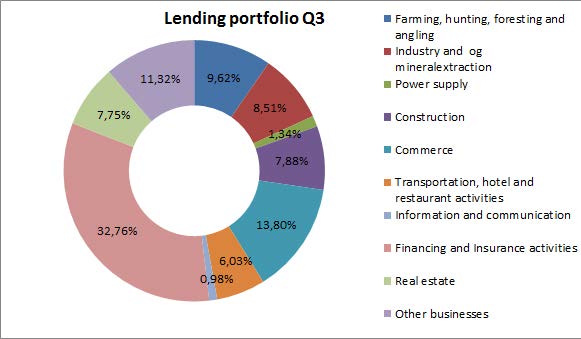

The lending portfolio as noted in the Q3 financial report is equally weighted between business and private costumers. No critical remarks have been noted for the private lending portfolio. Turning to the business

lending portfolio its composition is dominated by financing‐ and insurance companies (32.76%). This is a healthy sign since this line of business generally is in good standing. Further, it can be noted that the costumer group of farming, hunting, foresting and angling, which historically has been stressed and given rise to massive write downs, only holds a limited share of the portfolio (9.62%). The development in the lending portfolio since the 2012 annual report has also been positive. The costumer groups of financing and insurance has along with commerce grown significantly, whereas the weight of the more questionable group of farming, hunting, foresting and angling has diminished.

The financial crisis cried out for write downs due to worsened expectations to lendings. Nordfyns Bank has seemingly been taking these necessary write downs immediately upon appearance. Figure 3 draws a downward sloping picture as one would expect. This is notable, especially comparing to the development among two comparable banks; Vestfyns Bank and Lollands Bank. That Nordfyns Bank has been able to inflict themselves these massive write downs immediately upon the financial crisis displays that depositors are confident in Nordfyns Bank not fleeing away. Related to this, when winds howled outside management proved once again responsible and competent not hiding “ghosts in the closets” like similar banks show evidence of.

On the basis of the positive reports from Niro Invest and “Finanstilsynet” supplemented with a healthy lending portfolio and a particularly sensible write down profile it is our belief that Nordfyns Bank’s analytical quality is highly solid and fairly better than most immediate peers.

Valuation

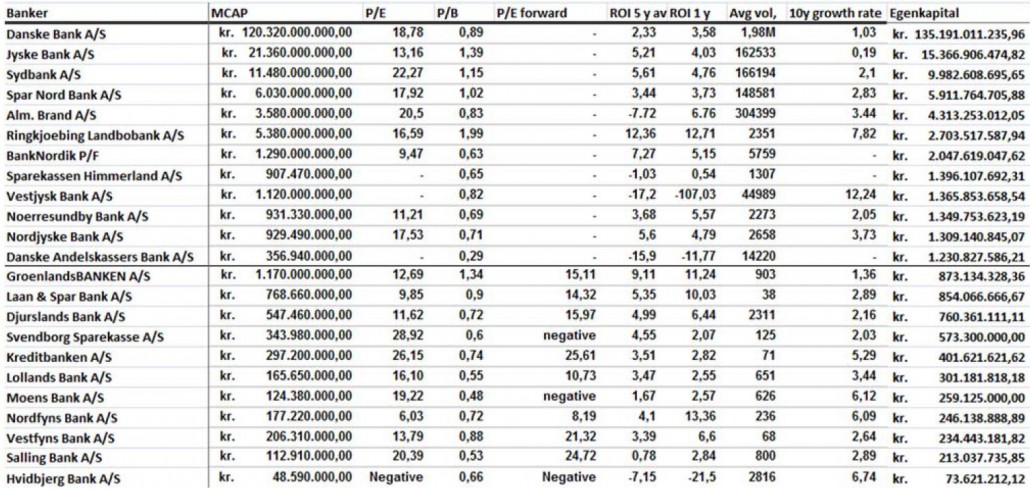

The valuation is based on a multiple comparison since we, referring to the introductory discussion of the banking sector, believe that the market generally is too harsh on a very unpopular sector undervaluing the sector as a whole. Further, most stressed small banks must be assumed failed at this point, and since the market typically has a hard time pricing small cap stocks we believe that small cap banks hold huge potential. The multiple comparison is based only on profitable Danish banks with equity of less than DKK 1.0 billion.

Looking at the price to book ratio Nordfyns Bank is located around the average. However, with a price to earnings ratio of 6.03 Nordfyns Bank is in fact by far the cheapest bank based on earnings. Further, it is noted that Nordfyns Bank had the highest ROI in the period Q3 2012 to Q3 2013 and also have performed better than average in the period Q3 2008 to Q3 2013. Lastly, we notice that the bank has had an impressive average growth rate over the last 10 years, however beaten by Vestjydsk Bank.

Based on the multiple comparison we feel confident in pointing out Nordfyns Bank as the best investment subject among Danish banks with equity less than DKK 1.0 billion.

Conclusion

Our quality assessment displays Nordfyns Bank as highly well‐managed and healthy. Management writes off as necessary and the bank is in position of a healthy lending portfolio and secure deposits. We believe that

the sector as a whole is undervalued, and since the multiple comparison reveals Nordfyns Bank as the strongest investment case among small Danish banks Investment Panel Aarhus recommends the stock.